SoundCloud Confirms Cyberattack, Limited User Data Exposed

A data breach of credit reporting and ID verification services firm 700Credit affected 5.6 million people, allowing hackers to steal personal information of customers of the firm's client companies. 700Credit executives said the breach happened after bad actors compromised the system of a partner company.

The post Hackers Steal Personal Data in 700Credit Breach Affecting 5.6 Million appeared first on Security Boulevard.

The Washington Post last month reported it was among a list of data breach victims of the Oracle EBS-related vulnerabilities, with a threat actor compromising the data of more than 9,700 former and current employees and contractors. Now, a former worker is launching a class-action lawsuit against the Post, claiming inadequate security.

The post Ex-Employee Sues Washington Post Over Oracle EBS-Related Data Breach appeared first on Security Boulevard.

The French Football Federation confirmed this week that attackers used stolen credentials to breach centralized administrative software managing club memberships nationwide, exposing personal information belonging to licensed players registered through clubs across the country.

The FFF detected the unauthorized access and immediately disabled the compromised account while resetting all user passwords across the system, though threat actors had already exfiltrated member databases before detection.

The breach exposed names, gender, dates and places of birth, nationality, postal addresses, email addresses, telephone numbers, and license numbers. The federation claimed the intrusion and exfiltration remained limited to these data categories, with no financial information or passwords compromised in the incident.

According to the federation, which has over two million members, many of whom are minors, the breached data includes personally identifiable information that could be leveraged for phishing attacks. The FFF reported a record number of over 2.3 million football license holders in the country for the 2023-2024 season, according to the latest publicly available figures.

This marks the third time in two years that the French Football Federation has suffered a cyberattack, with a March 2024 incident potentially exposing 1.5 million member records according to prosecutors. The pattern demonstrates persistent targeting of French sports organizations.

Cybersecurity researchers verified 18 months ago that a sample of FFF player details had been published on a well-known data leak forum, suggesting previous successful intrusions may have gone undetected.

The federation filed a criminal complaint and notified France's National Cybersecurity Agency ANSSI and data protection authority CNIL as required under European regulations. The FFF will directly contact individuals whose email addresses appear in the compromised database.

Federation officials warned members to exercise extreme vigilance regarding suspicious communications appearing to originate from the FFF or local clubs. Threat actors commonly leverage stolen personally identifiable information to craft convincing phishing messages requesting that recipients open attachments, provide account credentials, passwords, or banking information.

Security experts note that smaller clubs and societies sometimes consider themselves insufficiently interesting for criminals to target, but this incident demonstrates how deeply everyday life depends on centralized platforms vulnerable to credential compromise.

The federation stressed upon its commitment to protecting entrusted data while acknowledging that numerous organizations face increasing numbers and evolving forms of cyberattacks. "The FFF is committed to protecting all the data entrusted to it and continually strengthens and adapts its security measures in order to face, like many other organizations, the growing variety and new forms of cyber-attacks," the statement said.

The reliance on a single centralized administrative platform across all French football clubs created a high-value target where credential compromise granted attackers access to member records from thousands of clubs simultaneously.

Source: SitusAMC[/caption]

In the letter, the company reiterated that the incident is contained, services remain fully operational, and no encrypting malware was used. Clients were encouraged to reach out to the company’s security team for additional queries.

Source: SitusAMC[/caption]

In the letter, the company reiterated that the incident is contained, services remain fully operational, and no encrypting malware was used. Clients were encouraged to reach out to the company’s security team for additional queries.

SitusAMC, a services provider with clients like JP MorganChase and Citi, said its systems were hacked and the data of clients and their customers possibly compromised, sending banks and other firms scrambling. The data breach illustrates the growth in the number of such attacks on third-party providers in the financial services sector.

The post Hack of SitusAMC Puts Data of Financial Services Firms at Risk appeared first on Security Boulevard.

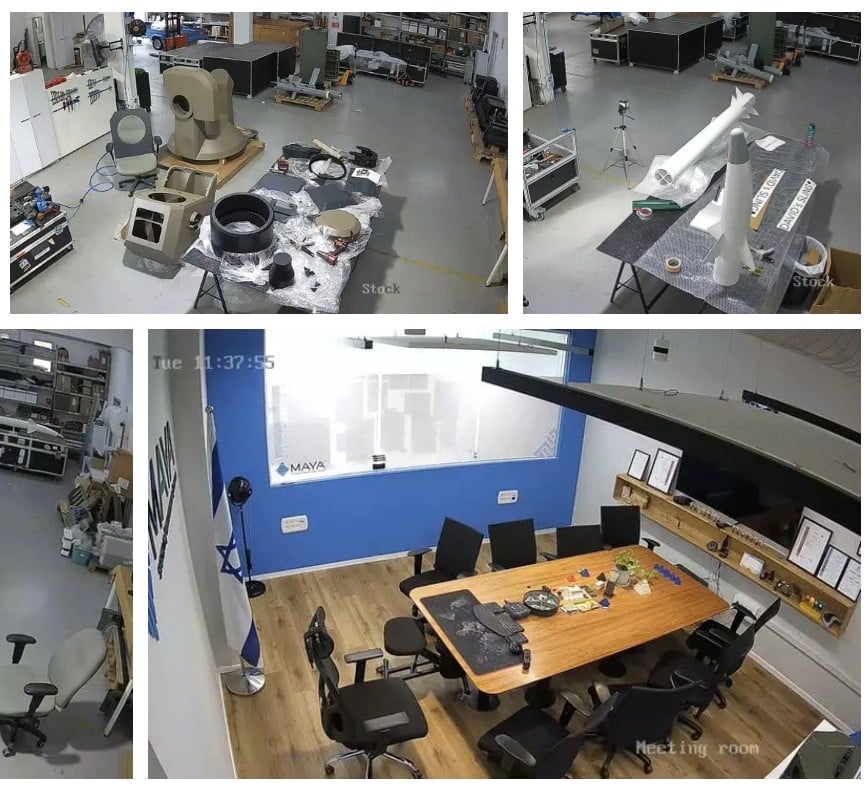

October 12 Telegram post by Cyber Toufan claiming Maya hack[/caption]

However, the group claims to have had access to Maya’s systems for more than a year.

“One and a half years after gaining full access to the network, we have explored every part of it and reached the QNAP archive,” claims a Cyber Toufan post reported by International Cyber Digest on X. “Through the systems, we have breached Elbit and Rafael's through then. Their phones, printers, routers and cameras as well. We have recorded your meetings with sound and video for over a year. This is just the beginning with Maya!”

Footage released by the group shows company employees allegedly working on several defense systems, including missile and drone systems, and the group also claims to possess technical drawings of sensitive parts like missile components.

October 12 Telegram post by Cyber Toufan claiming Maya hack[/caption]

However, the group claims to have had access to Maya’s systems for more than a year.

“One and a half years after gaining full access to the network, we have explored every part of it and reached the QNAP archive,” claims a Cyber Toufan post reported by International Cyber Digest on X. “Through the systems, we have breached Elbit and Rafael's through then. Their phones, printers, routers and cameras as well. We have recorded your meetings with sound and video for over a year. This is just the beginning with Maya!”

Footage released by the group shows company employees allegedly working on several defense systems, including missile and drone systems, and the group also claims to possess technical drawings of sensitive parts like missile components.

Last week on Malwarebytes Labs:

Stay safe!

We don’t just report on scams—we help detect them

Cybersecurity risks should never spread beyond a headline. If something looks dodgy to you, check if it’s a scam using Malwarebytes Scam Guard, a feature of our mobile protection products. Submit a screenshot, paste suspicious content, or share a text or phone number, and we’ll tell you if it’s a scam or legit. Download Malwarebytes Mobile Security for iOS or Android and try it today!

Update – October 30, 2025: New information confirms that Conduent’s 2024 breach has impacted over 10.5 million people, based on notifications filed with multiple state attorneys general. The largest disclosure came from the Oregon government, which reported a total of 10.5 million affected US residents. Additional notices listed 4 million in Texas, 76,000 in Washington, and several hundred in Maine.

Even if you’ve never heard of Conduent, you could be one of the many people caught up in its recent data breach. Conduent provides technology services to several US state governments, including Medicaid, child support, and food programs, with the company stating that it “supports approximately 100 million US residents across various government health programs, helping state and federal agencies.”

In a breach notification, Conduent says:

“On January 13, 2025, we discovered that we were the victim of a cyber incident that impacted a limited portion of our network.”

An investigation found that an unauthorized third party had access to its systems from October 21, 2024, until the intrusion was stopped on discovery.

Breach notification letters will be sent to affected individuals, detailing what personal information was exposed. According to The Record, Conduent said more than 400,000 people in Texas were impacted, with data including Social Security numbers, medical information and health insurance details. Another 76,000 people in Washington, 48,000 in South Carolina, 10,000 in New Hampshire and 378 in Maine were also affected. Conduent has filed additional breach notices in Oregon, Massachusetts, California, and New Hampshire.

The stolen data sets may include:

If all of those apply, it’s certainly enough for criminals to commit identity theft.

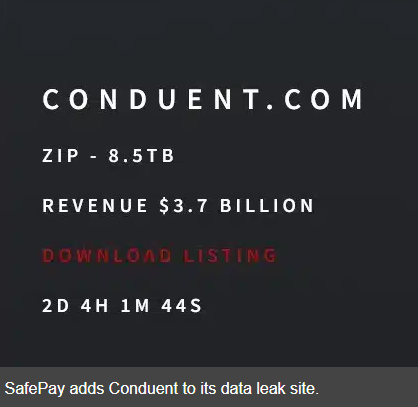

Ransomware group SafePay reportedly claimed responsibility for the attack and listed Conduent on its leak site.

SafePay, which emerged in late 2024, threatened to publish or sell stolen data if its demands weren’t met, claiming to have exfiltrated a staggering 8.5 terabytes of files from Conduent’s systems. Though relatively new on the scene, SafePay has quickly built a reputation for large-scale extortion targeting high-profile clients globally.

Breaches like this reinforce the need for robust cybersecurity and incident response in the public sector. For the potentially millions of people affected, stay alert to fraud and identity theft.

If you think you’ve been the victim of this or any other data breach, here are steps you can take to protect yourself:

We don’t just report on threats – we help safeguard your entire digital identity

Cybersecurity risks should never spread beyond a headline. Protect your—and your family’s—personal information by using identity protection.

Australia's Privacy Commissioner Carly Kind has issued a determination against online wine wholesaler Vinomofo Pty Ltd, finding the company interfered with the privacy of almost one million individuals by failing to take reasonable steps to protect their personal information from security risks.

The determination represents one of the most comprehensive applications of Australian Privacy Principle 11.1 (APP 11.1) to cloud migration projects and provides critical guidance for organizations undertaking similar infrastructure transitions.

The finding follows a 2022 data breach that occurred during a large-scale data migration project, exposing approximately 17GB of data belonging to 928,760 customers and members. The determination goes beyond technical security failures, identifying systemic cultural and governance deficiencies that Commissioner Kind found demonstrated Vinomofo's failure to value or nurture attention to customer privacy.

In 2022, Vinomofo experienced a data breach amid what the company described as a "large data migration project." An unauthorized third party gained access to the company's database hosted on a testing platform, which, despite being separate from the live website, contained real customer information.

The exposed database held approximately 17GB of data comprising identity information including gender and date of birth, contact information such as names, email addresses, phone numbers, and physical addresses, and financial information. The breach initially came to light when security researcher Troy Hunt flagged the incident on social media, and subsequent investigation revealed the stolen data had been advertised for sale on Russian-language cybercrime forums.

The testing platform exposure reveals a fundamental security misconfiguration that has become increasingly common as organizations migrate to cloud infrastructure. Testing and development environments frequently contain production data but receive less rigorous security controls than production systems, creating attractive targets for threat actors who recognize this vulnerability pattern.

Vinomofo's initial public statements downplayed the breach's severity, emphasizing that the company "does not hold identity or financial data such as passports, drivers' licences or credit cards/bank details" and assuring customers that "no passwords, identity documents or financial information were accessed." However, the Privacy Commissioner's investigation revealed more significant failures in the company's security posture and governance.

Perhaps the determination's most significant finding concerns Vinomofo's organizational culture. Commissioner Kind concluded that "Vinomofo's culture and business posture failed to value or nurture attention to customer privacy, as exemplified by failures regarding its policies and procedures, training, and cultural approach to privacy."

This cultural assessment goes beyond technical security measures to examine the organizational prioritization of privacy protection. The Commissioner observed that privacy wasn't embedded into business processes, decision-making frameworks, or corporate values—it remained peripheral rather than fundamental to operations.

The determination identified specific manifestations of this cultural failure:

Policy and Procedure Deficiencies: Vinomofo lacked adequate policies governing data handling during migration projects, security requirements for testing environments, and access controls for sensitive customer information.

Training Inadequacies: The company failed to provide sufficient privacy and security training to personnel involved in data migration and infrastructure management, resulting in preventable errors and oversights.

Cultural Approach: Privacy considerations weren't integrated into strategic planning, risk management, or operational decision-making processes, treating privacy compliance as a checkbox exercise rather than a core business imperative.

The Commissioner's determination revealed that Vinomofo was aware of deficiencies in its security governance and recognized the need to uplift its security posture at least two years prior to the 2022 incident. This finding transforms the breach from an unfortunate accident into a foreseeable consequence of deliberate inaction.

The determination states: "The respondent was aware of the deficiencies in its security governance and that it needed to uplift its security posture at least 2 years prior to the Incident." This awareness without corresponding action demonstrates a failure of corporate governance that extended beyond the IT security function to board and executive leadership levels.

Organizations face resource constraints and competing priorities that can delay security improvements. However, the Commissioner's finding that Vinomofo knew about security deficiencies for two years before the breach eliminates any claim of unforeseen circumstances. This represents a calculated risk—one that ultimately materialized with consequences for nearly one million customers.

The determination centers on Australian Privacy Principle 11.1, which requires entities holding personal information to take "such steps as are reasonable in the circumstances" to protect that information from misuse, interference, loss, unauthorized access, modification, or disclosure.

The Commissioner concluded that "the totality of steps taken by the respondent were not reasonable in the circumstances" to protect the personal information it held. This holistic assessment examines not individual security controls but the comprehensive security program considering organizational context, threat environment, and data sensitivity.

The determination provides valuable guidance on how "reasonable steps" should be interpreted in the context of data migration projects, particularly when using cloud infrastructure providers. Key considerations include:

Cloud Security Responsibilities: Organizations cannot delegate privacy obligations to cloud service providers. While providers like Amazon Web Services (where Vinomofo hosted its database) offer security features and controls, customers remain responsible for properly configuring and managing those controls.

Testing Environment Security: Testing and development environments containing real customer data must receive security controls commensurate with the sensitivity of that data. The separation from production systems doesn't reduce security obligations when personal information is involved.

Migration Risk Management: Data migration projects create heightened security risks during transition periods when data exists in multiple locations, access patterns change, and configurations evolve. Organizations must implement enhanced controls during migrations to address these elevated risks.

Awareness and Action: Knowing about security deficiencies creates an obligation to address them within reasonable timeframes. Extended delays between identifying risks and implementing mitigations may constitute unreasonable conduct under APP 11.1.

The determination's emphasis on cloud infrastructure provider obligations addresses a widespread misunderstanding of the shared responsibility model that governs cloud security. Cloud providers offer infrastructure and security capabilities, but customers must properly configure and manage those capabilities to protect their data.

Amazon Web Services, where Vinomofo stored the exposed database, provides extensive security features including encryption, access controls, network isolation, and monitoring capabilities. However, these features require proper implementation and configuration by customers. A misconfigured S3 bucket, overly permissive access policies, or inadequate network controls can expose data despite the underlying platform's security capabilities.

The breach appears to have resulted from Vinomofo's configuration and management of its AWS environment rather than vulnerabilities in AWS itself. This pattern has become common in cloud data breaches—organizations migrate to cloud platforms attracted by scalability and cost benefits but lack the expertise or diligence to properly secure their cloud deployments.

For organizations using cloud infrastructure providers, the determination establishes clear expectations:

Configuration Management: Organizations must implement rigorous configuration management processes ensuring security settings align with best practices and data protection requirements.

Access Controls: Cloud environments require carefully designed access control policies following least-privilege principles. The flexibility of cloud platforms can create excessive access if not properly managed.

Monitoring and Detection: Cloud platforms provide extensive logging and monitoring capabilities, but organizations must actively use these capabilities to detect suspicious activity and security misconfigurations.

Expertise Requirements: Securing cloud environments requires specialized knowledge. Organizations must ensure personnel managing cloud infrastructure possess appropriate expertise or engage qualified consultants.

The Commissioner made several declarations requiring Vinomofo to cease certain acts and practices, though specific details weren't disclosed in the public announcement. These declarations typically include requirements to:

Implement comprehensive information security programs addressing identified deficiencies, conduct regular security assessments and audits of systems handling personal information, provide privacy and security training to relevant personnel, establish privacy governance frameworks with clear accountability and oversight, and review and enhance policies and procedures governing data handling, particularly during migration projects.

The declarations serve multiple purposes beyond Vinomofo's specific case. They provide a roadmap for other organizations undertaking similar cloud migrations or managing customer data at scale. They establish regulatory expectations about minimum acceptable security practices. And they create precedent that future enforcement actions can reference when addressing similar failures.

After a misinterpretation of an interview with a security researcher, several media outlets hinted at a major Gmail breach.

Reporters claimed the incident took place in April. In reality, the researcher had said there was an enormous amount of Gmail usernames and passwords circulating on the dark web.

Those are two very different things. The credentials probably stem from a great many past attacks and breaches over the years.

But the rumors spread quickly—enough that Google felt it had to deny that their Gmail systems had suffered a breach.

“The inaccurate reports are stemming from a misunderstanding of infostealer databases, which routinely compile various credential theft activity occurring across the web. It’s not reflective of a new attack aimed at any one person, tool, or platform.”

What happens is that cybercriminals buy and sell databases containing stolen usernames and passwords from data breaches, information stealers, and phishing campaigns. They do this to expand their reach or combine data from different sources to create more targeted attacks.

The downside for them is that many of these credentials are outdated, invalid, or linked to accounts that are no longer in use.

The downside for everyone else is that misleading reporting like this causes panic where there’s no need for it—whether it stems from misunderstanding technical details or from the pressure to make a headline.

Still, it’s always smart to check whether your email address has been caught up in a breach.

You can use our Digital Footprint scanner to see if your personal information is exposed online and take steps to secure it. If you find any passwords that you still use, change them immediately and enable multi-factor authentication (2FA) for those accounts wherever possible.

We don’t just report on data privacy—we help you remove your personal information

Cybersecurity risks should never spread beyond a headline. With Malwarebytes Personal Data Remover, you can scan to find out which sites are exposing your personal information, and then delete that sensitive data from the internet.

Peer-to-peer lending marketplace Prosper detected unauthorized activity on their systems on September 2, 2025.

It published an FAQ page later that month to address the incident. During the incident, the attacker stole personal information belonging to Prosper customers and loan applicants.

As Prosper stated:

“We have evidence that confidential, proprietary, and personal information, including Social Security numbers, was obtained, including through unauthorized queries made on Company databases that store customer and applicant data.”

While Prosper did not share the number of affected people, BleepingComputer reported that it affected 17.6 million unique email addresses.

The stolen data associated with the email addresses reportedly includes customers’ names, government-issued IDs, employment status, credit status, income levels, dates of birth, physical addresses, IP addresses, and browser user-agent details.

Prosper advised that no one gained unauthorized access to customer accounts or funds and that their customer-facing operations continued without interruption.

Even without account access, the stolen data is more than enough to fuel targeted, personalized phishing and even identity theft. The investigation is still ongoing but Prosper has promised to offer free credit monitoring, as appropriate, after determining what data was affected.

If you think you have been the victim of a data breach, here are steps you can take to protect yourself:

We don’t just report on threats – we help safeguard your entire digital identity

Cybersecurity risks should never spread beyond a headline. Protect your—and your family’s—personal information by using identity protection.

Mango has reported a data breach at one of its external marketing service providers. The Spanish fashion retailer says that only personal contact information has been exposed—no financial data.

The breach took place at the service provider and did not affect Mango’s own systems. According to the breach notification, the stolen information was limited to:

“Under no circumstances has your banking information, credit cards, ID/passport, or login credentials or passwords been compromised.”

Because Mango operates in more than 100 countries, affected individuals could be located across multiple regions where Mango markets to customers through its external partner. As Mango has not named the third-party provider or disclosed how many customers were affected, we cannot precisely identify where these customers are located.

Mango has not released any details about the attackers behind the breach. Although the stolen data itself does not pose an immediate risk, cybercriminals often follow breaches like this with phishing campaigns, exploiting the limited personal information they obtained.

We’ll update this story if Mango releases more information about the breach or the customers impacted.

Affected customers say they have received a data breach notification of which we have seen screenshots in Spanish and English.

If you think you have been the victim of a data breach, here are steps you can take to protect yourself:

Malwarebytes has a free tool for you to check how much of your personal data has been exposed online. Submit your email address (it’s best to give the one you most frequently use) to our free Digital Footprint scan and we’ll give you a report and recommendations.

A blood center has begun sending data breach notifications to its users after suffering a ransomware attack and theft of personal data.

The New York Blood Center’s (NYBC) suffered the ransomware attack in January, in which an unauthorized party gained access to its network and acquired copies of a subset of files. The security incident was first noticed on January 26, 2025, but this week NYBC has started notifying victims.

NYBC publicly acknowledged the scale but has not issued a precise number of affected people due to ongoing investigations and limitations in contact information for all service recipients. Based on documents that NYBC submitted to regulators in several states, hackers could have stolen information belonging to at least tens of thousands of people.

NYBC ranks among the largest independent community-based blood collection organizations in the US. It serves over 75 million people across more than 17 states and delivers about one million lifesaving blood products annually.

The information varies per affected individual but can include:

NYBC also provides clinical services, and diagnostic blood testing, for which it needs clinical information from healthcare providers. New York Blood Center Enterprises said some of this information was also accessed by the attackers during the cyber incident.

So far it is unknown which ransomware group might have been behind the attack, and we have seen no threats to publish or sell the acquired data. But this could change quickly once negotiations about the ransom come to an end without the cybercriminals getting paid what they demand.

There are some actions you can take if you are, or suspect you may have been, the victim of a data breach.